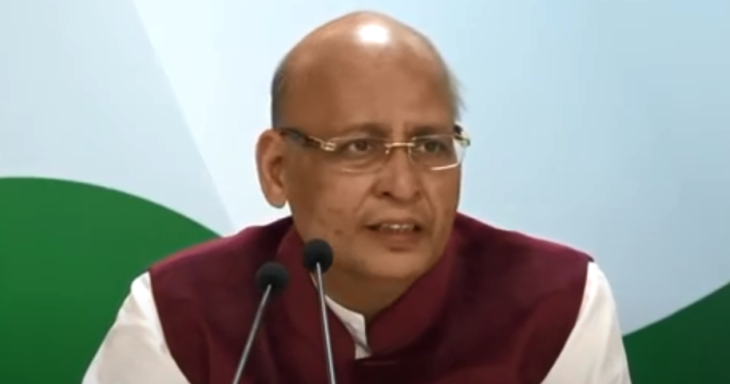

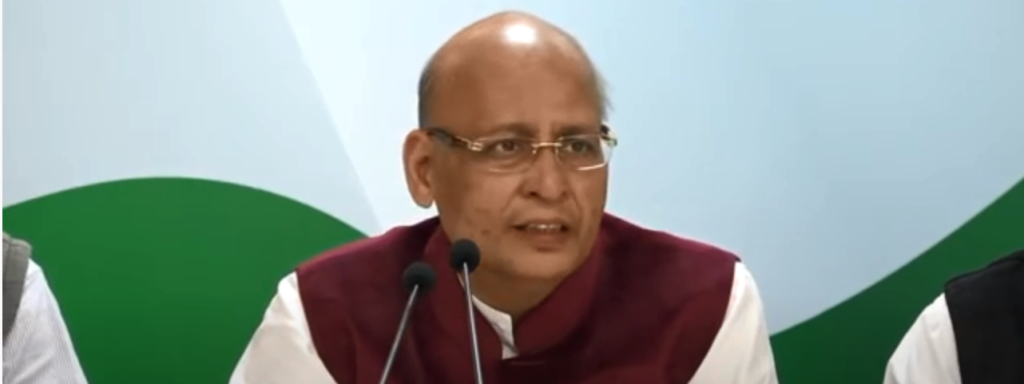

Congress member and GamesKraft lawyer Dr. Abhishek Singhvi criticises 28% GST decision on real money gaming

Prepend to the content

Leading senior counsel and Rajya Sabha member Dr. Abhishek Manu Singhvi on Saturday criticised the government’s decision to increase the tax rate on online real money gaming, casinos, and horse racing to GST on the full face value.

Dr. Singhvi earlier represented gaming companies in several cases before various High Courts and the Supreme Court. His representations include challenging the constitutional basis of ban laws enacted by states like Karnataka and tax demands by the GST department.

ये सरकार काफी निर्दयी है। ना तो रोज़गार दे रही है, बेरोज़गार पैसे कमाने जाए तो उसमें भी अच्छा ख़ासा टुकड़ा खा लेती है। क्रिप्टो वाले भी परेशान, #fantasysports वाले भी परेशान। वाह मोदीजी वाह!!

— Abhishek Singhvi (@DrAMSinghvi) July 15, 2023

Dr. Singhvi alongside representing GamesKraft in 2021 had raised a question in the upper house on games of skill and games of chance. He had to drop the question after conflict of interest allegations.

Singhvi jons the list of Goa Transport Minister Mauvin Godinho and Karnataka minister Priyank Kharge. Mauvin Godinho said he would write to the Union Finance Minister Nirmala Sitharaman for a reconsideration of the Council’s decision.

Increased tax burden, according to the industry might mean users shifting to illegal offshore websites and suffer heavy financial losses due to unregulated nature of these platforms.

Talking about the impact, the Karnataka IT minister Priyank Kharge said the decision might potentially hinder India’s goal to become a US$ 1 trillion digital economy by 2025. Reports indicate that the country has seen a massive growth rate in the gaming sector post Covid19 which could potentially reduce now.

All though several influential members of Congress have come out to criticise the decision, none of the Congress ruled states have opposed the issue in the GST Council.

The proposal is a major decision considering the fact that all states require to amend the state GST enactments while the central government needs to amend CGST and IGST Acts for implementation. Any state refusing to carry out amendments might result in an unique constitutional crisis.

The post Congress member and GamesKraft lawyer Dr. Abhishek Singhvi criticises 28% GST decision on real money gaming appeared first on G2G News.